You do business.

We do the numbers.

Bookkeeping, tax and payroll, with wealth management for small businesses.

True or false?

Administrative tasks can be relentless—especially the money stuff. Bookkeeping, payroll, and taxes are what nightmares are made of. So, you feel stuck between a rock and a hard place.

Do you…

- continue to spin your wheels on tasks you’re not trained to do? Or,

- let some things slide, hoping it doesn’t get you in trouble with the IRS?

There's a better option.

YOU MAY NOT HAVE STARTED A BUSINESS TO LIVE KNEE DEEP IN THE NUMBERS–BUT, WE DID.

We believe small business owners deserve a life outside their work—without risking anything falling through the cracks. That’s why, with all-in-one bookkeeping, payroll, tax, and wealth management services, we’ve devoted our small business to helping you manage yours.

You've taken an important first step.

We also know that even considering something other than “the way you’ve always done it” takes intentional effort, time, and frankly—courage. So, we honor your decision to reach out and promise to bring as much value as we can while you examine our services.

Our approach is different than most.

CPA-Level Precision & Guidance

Your dedicated, two-person, CPA-led team will take over your bookkeeping, tax, and payroll services and keep them flowing with incredible accuracy. Plus, you’ll get monthly reports, recaps, and recommendations so you never miss a beat.

Tax Planning & Saving

No more wondering how much you should save, when you should go for the tax write-off, or what opportunities are passing you by. We’ll help you optimize your tax strategy so you can make a frustrating system work for you.

Personal & Business Integration

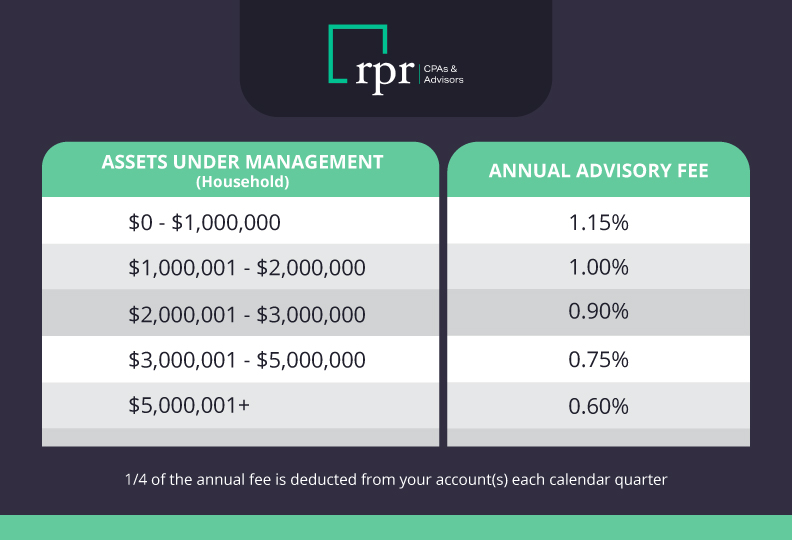

As small business owners, it can be hard to separate business and personal. With so much overlap, we offer add-on financial planning and investment management from our in-house financial advisory team.

It's easy to begin.

But, don’t worry: the transition is way less cumbersome than it feels.

1

Jump on a call to see if we’re a match.

Simply pick a time to chat with one of our CPAs to discuss your needs and our solutions. We promise absolutely no pressure, just a conversation.

2

Pick the package that fits your needs.

When you’re ready to move forward, choose from three customizable, monthly subscription services that align with most small business goals and budgets.

3

Be as hands-on or as hands-off as you’d like.

Our goal is to take all the stress out of your money stuff, but we get that you may want to do some things yourself. We respect your authority and will follow your lead!

Packages & Pricing

Each package includes bookkeeping & support on a monthly basis, but you get to choose how often you want to receive the full financial reporting packet:

Select a Reporting Frequency:

Essentials

Ideal for businesses who need

accounting support

$395/Month

Essentials Includes:

Accounting Services

- Dedicated accounting team with

- Monthly Financial Reports:

- Balance Sheet

- Profit & Loss

- Statement of Cash Flows

- Year-End Financials for Tax Preparation

- Quickbooks Online (QBO) subscription

- Secure Online Portal

- Cloud Based File Storage

- Cloud Based Bill Pay

Encompass

Ideal for business owners that

need accounting & tax support

$595/Month

Everything in Essentials PLUS:

Accounting Services

- Dedicated accounting & tax team led

by a CPA

Tax Services

- Tax Planning During the Year

- Strategies to Reduce Taxes

- Retirement Planning Consultation

- Annual Income Tax Filing for Business

- Annual Income Tax Filing for Owner*

Wealth Management Services

- 10-Point Personal Financial Assessment

- Investment Tax Efficiency Review

Enterprise

Ideal for businesses with

more complex needs

Custom Pricing

Everything in Essentials &

Encompass PLUS:

Managerial Accounting Services

- Managerial Financial Reporting

- Payroll Services

- Sales Tax Services

Premium Services

- CFO Services

- Accounts Payable & Receivable Services

- Key Performance Indicator (KPI)Analysis

- Trend Analysis

- Business Planning & Budgeting

Wealth Management Services

- Business Retirement Plan Evaluation

- Personal Investment Analysis

Essentials

Ideal for businesses who need

accounting support

$295/Month

Essentials Includes:

Accounting Services

- Dedicated accounting team with

- Quarterly Financial Reports:

- Balance Sheet

- Profit & Loss

- Statement of Cash Flows

- Year-End Financials for Tax Preparation

- Quickbooks Online (QBO) subscription

- Secure Online Portal

- Cloud Based File Storage

- Cloud Based Bill Pay

Encompass

Ideal for business owners that

need accounting & tax support

$495/Month

Everything in Essentials PLUS:

Accounting Services

- Dedicated accounting & tax team led

by a CPA

Tax Services

- Tax Planning During the Year

- Strategies to Reduce Taxes

- Retirement Planning Consultation

- Annual Income Tax Filing for Business

- Annual Income Tax Filing for Owner*

Wealth Management Services

- 10-Point Personal Financial Assessment

- Investment Tax Efficiency Review

Enterprise

Ideal for businesses with

more complex needs

Custom Pricing

Everything in Essentials &

Encompass PLUS:

Managerial Accounting Services

- Managerial Financial Reporting

- Payroll Services

- Sales Tax Services

Premium Services

- CFO Services

- Accounts Payable & Receivable Services

- Key Performance Indicator (KPI)Analysis

- Trend Analysis

- Business Planning & Budgeting

Wealth Management Services

- Business Retirement Plan Evaluation

- Personal Investment Analysis

Essentials

businesses

$295/Monthly

Essentials Includes:

Accounting Services

- Quickbooks Online (QBO) subscription

- Monthly Financial Reports*

- Dedicated team with

- Balance Sheet

- Profit & Loss

- Statement of Cash Flows

- Owner Tax Summary

- Secure Online Portal

- Cloud Based File Storage

- Cloud Based Bill Pay

- Year-End Financials for Tax

Encompass

that need more support

$495/Monthly

Essentials Includes:

Accounting Services

- CPA led-Team

- Tax Planning

- Payroll Service **

- Strategies to Reduce Tax Liability

- Trend Analysis

- Annual Income Tax Filing for Business

- Annual Income Tax Filing

Enterprise

Custom Pricing

Essentials Includes:

Accounting Services

- Managerial Monthly Financial Reports

- CFO Services

- Key Performance Indicator (KPI)

- Business Planning & Budgeting

- Sales Tax Assistance

- Accounts Payable & Receivable

Additional Services

Accounting and Tax Services

- Payroll Services

- Sales Tax Services

Wealth Management Services

- Comprehensive Financial Planning

- Investment & Retirement Income Management

- IRA’s, 401(k) Plans, Rollovers

- Social Security & Medicare Planning

*Subject to additional fees based on complexity

**Essentials & Encompass Plans are subject to thresholds on number of transactions, accounts, and employees; Businesses exceeding those thresholds would qualify for our Enterprise package.

You might still be wondering...

No need to be self-conscious! We’ve seen it all and can handle it. Don’t let the status of your bookkeeping keep you from getting started

We work with all accounting systems and will help make your system as efficient and user-friendly as possible.

We’re a CPA firm with a 45+ year history. We stay current with the tax code and find ways to make it work for you, not against you.

For most of our clients, we prepare their personal taxes as well as their business taxes. Having us do the business accounting & taxes helps us to be able to plan for, minimize, and prepare your personal taxes.

With our series of packages, we are providing you with financial information that will give you guidance and insight to help you make informed business decisions. If your business needs additional support and guidance, that is where our custom plans including outsourced CFO Services come in.

Our Custom services can accommodate most out-of-the-ordinary situations. Please describe what you’re looking for and together we’ll see if we’re a good fit.