Smart money guidance for an on-purpose future.

Don't just hope for the best.

So, you worry (or, let’s be honest—your spouse worries)…

- Will you have to work forever?

- Are you saving enough for retirement?

- Could you be paying too much in taxes?

financial resources available to them—and, as hard as you work, we believe:

You deserve to take full

advantage of all that you’re due.

You've taken an important first step.

For many business owners, this is a largely uncoordinated effort with separate entities. But at RPR financial, our team of diversely talented professionals work together with an all-hands-on-deck approach, sharing thoughts and ideas, proactively aligned around your goals.

Our approach is different than most.

Personal & Business Wealth Management

Our seasoned fiduciaries specialize in financial planning and investment management for you as the business owner and your family.

Tax Planning & Saving

No more wondering how much you should save, how much is safe to tie up in IRAs, or what other opportunities are passing you by. We’ll help you optimize your tax strategy so you can make a frustrating system work for you.

CPA-Level Accounting Services

At your request, our CPA-led team can handle your bookkeeping, tax, and payroll services and keep them flowing with incredible accuracy. Plus, you’ll get monthly reports and recommendations so you never miss a beat.

It's easy to begin.

But, don’t worry: the transition is way less cumbersome than it feels.

1

Reach out to chat with an advisor

Our clients say we're "down to earth" and "approachable," and we intend to live up to our reputation. So, bring all your questions; we're looking forward to getting to know you!

2

Get a plan designed just for you.

Assuming we’re a fit, we’ll learn about your personal and business goals. Then, we’ll offer a truly personalized recommendation—free from corporate mandates and commissions.

3

Know you’re doing it

right.

This is where things get really fun! With clearly stated guidance and time-saving support, you can build your business and your wealth—without doubt or regret.

You might still be wondering...

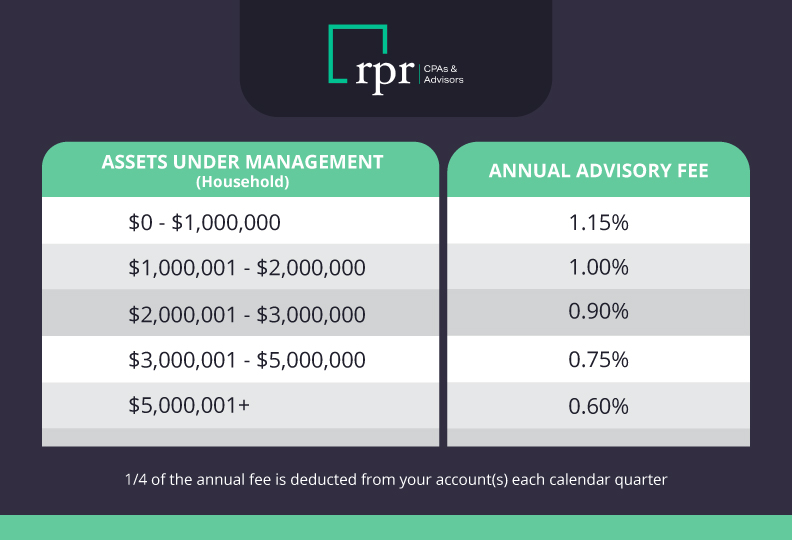

- We are fee-based financial advisors who operate as fiduciaries, not as commissioned salespeople. As such, our advisory fee is a percentage of the total assets we manage.

- An hourly rate is charged should there be no assets to manage, and stand-alone financial planning agreement is all that is needed.

- Company Retirement Plans normally have their own fees for record keeping and third-party administration, but we try to only use sources that keep their fees reasonable.

- See our Pricing Chart

Our advisory fee covers investment management, financial planning, retirement income planning, account management, distribution requests, etc.

We are regulated by agencies in each state where we have advisory clients. We also have a 3rd party compliance firm for oversight and guidance.

A fiduciary is a person or organization that acts on behalf of another person or persons, putting their clients’ interests ahead of their own, with a duty to preserve good faith and trust. Being a fiduciary thus requires being bound both legally and ethically to act in the other’s best interests. We at RPR Financial operate as fiduciaries.

- Our firm is unique in that we have both Wealth Management and Tax Services under one roof. Our CPA division can work with you on your taxes.

- We also coordinate with existing tax professionals should you already have a relationship in place.

Yes! Both are vitally important in your overall financial plan. We routinely monitor as you’re approaching the qualifying age, and proactively help you with the process.

We will evaluate your options and decide on the best course of action. This might include rolling it into your current 401(k) or into a personal IRA.

There are tax implications and many ways to invest instant surpluses. We’ll give recommendations for what will work best for you, now and for the future. Lump sums could include inheritances, sale of a business, bonuses and other situations. For an inheritance where you’re the executor or trustee, we’ll give you guidance on how to proceed.